Colombian Update June 8 : Whats New (s) : COLCAP Prospects, Reficar.

- Rupert Stebbings

- Jun 7, 2018

- 7 min read

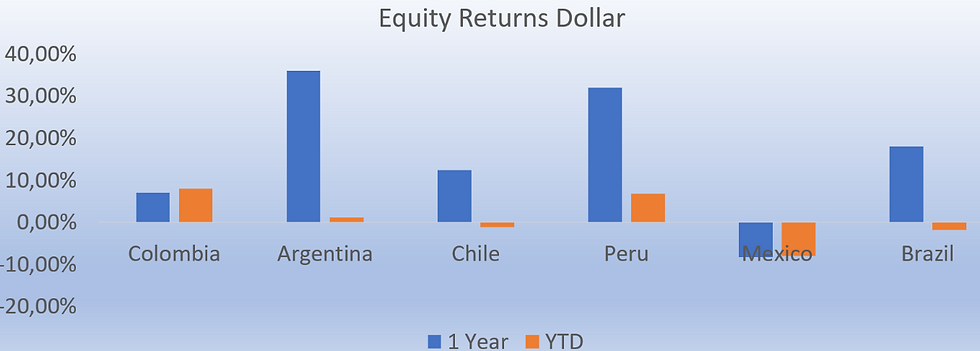

COLCAP POST ELECTION

A couple of days ago I found myself with my nose pressed against the glass having a look at what my old chums at Valores were recommending for the rest of the year, both the COLCAP overall and individual top picks, in terms of stock picks I find myself in general agreement however in terms of the COLCAP itself my thoughts are mixed. This week a foreign investor over a fine hamburger told me he thought Colombiawas looking cheap, two words you don't often find in the same sentence - my argument has always been that stocks are cheaper than they look due to their monopolistic tendencies in a country of 50 million people however this time we are talking cheap in general. If we take a look at the COLCAP in dollar terms we find a mixed picture for those foreign funds who might be taking a fresh look at cheap Colombia - this year whilst the index has risen less than 3% we find that oil prices have boosted the Peso and therefore given those overseas a YTD return of around 8%which is the best return in the region thus far in 2018 however that accounts for all of the dollar based return for the last year and with the exception of Mexico which operating under the cloud of Labrador Colombia's return of 8% over that year has been dwarfed by other countries in Latam. In terms of Colombia, due to that same oil price we have seen the COLCAP lose 36% in dollar terms over the past 5 years, it may have lost just 1% in Peso terms but even that modest decline has seen local investors heading for the hills as the previous 5 years had seen Peso and Dollar returns of 69% & 90% respectively, a little spoilt one might say. One of the great trends over the last couple of years has been the flight of individual private money out of equities and the volume domination of local AFPs and foreigners. One wonders with the market having done next to nothing in Peso terms and bond yields dropping whether the individuals might now be tempted back in. Valores are shooting for 1650 which is around 6% up from here, my feel is that it is too high or way too low. If all things remain equal in a post Duque election win scenario I foresee money coming into the market - as we know by now he wouldn't have been my pick but nonetheless Colombia will remain with the most stable political situation in Latam. If we bolt on to that the fact that he will inherit an economy which is now well off the bottom and where 4G is starting to kick-in with the added factor of climbing confidence level then the market should move - it is easy to forget we already breached 1600 earlier in 2018. A more pessimistic scenario would revolve around external shocks which might see money steered away from Latam, we have elections on the horizon in the main regional peers and on top of that a US economy which isn't too sure where it wants to go - in that scenario I doubt we will move substantially. Overall though it is reasonable to expect gains and if locals decide to chase returns and come back to the equity market it could be a decent six months.

Moving briefly to the stock picks at Valores (Cementos Argos, Grupo Argos, Nutresa, Exito & Canacol) you will make money on all of those but I would slightly adjust it :

Cementos Argos has bounced marginally of late but it is simply put the best pick to be found, the progress of 4G is being underestimated and it should be a core holding.

Exito is geared up for the rise in Consumer Confidence in a consumer driven society, you could argue it is as much a play on Brazil as Colombia but in the end the profits go into the same bank account.

Canacol - the executives of this company have done simply amazing work during the oil crisis re-inventing themselves as a premier gas company with a pipeline (pun alert) of projects coming and they are already in the process of selling their oil assets, its track record over recent years is stability as they changed direction - why would it be 'speculative' ?

I am a great admirer of Nutresa full stop but I wouldn't have it as a top pick for the coming rally as historically it isn't volatile which is due to the high quality of the asset, it is a classic bunker stock and is a top pick as a long term safe investment.

Instead I would pick Avianca as extra exposure to rising Consumer Confidence, a Peso that is encouraging people to travel overseas and the fact that the company is quietly moving more of its focus to the higher return international routes.

Finally Grupo Argos would also not make my 'top' list for the simple reason that you already have Cementos Argos on the list - there is also Celsia who are innovating like crazy within the portfolio along with the Real Estate business which is now moving in the right direction however this is a slow burner and won't impact numbers for some time.

Instead my last few Pesos I would placed on Grupo Sura - it has exposure to any macro recovery driving the banking sector via Bancolombia, it has been a huge underperfomer (SURA ORD 18 months -2% v's BCOLO +31%) and finally they have a regional plan which they will execute.

Having said all that a rising tide lifts all boats and if all things remain equal that is where we should be....and of course differing options are what make a market.

A look out of the bedroom window tells you the story

REFICAR The story of the corruption at Reficar has been festering for a while, there were rumblings since before the audit in 2015 by the Controller's Office, in the same year that CB&I were sued for US$2bn in overspend. We have had the prosecutors office seeking discussions with 8 officials earlier this year, others involved in the overseeing of the project have appeared at hearings in front of the Senate and now the Controller's office has placed charges against 20 officials, including an ex CEO, for the US$2.4bn overspend at the project that was inaugurated in 2015. Last year we even saw a delay in EC's 20F filing by PW&C as they were trying to tie up some of Reficar loose ends. Very unfortunately there is no way of tip toeing around the subject of corruption at Reficar, it was a very well thought out project which has produced a world class result but it is a window into many of the problems here in Colombia.

The project was the brainchild of Alvaro Uribe back in 2004 during his first Presidency and it was decided that the private sector should be as heavily involved as possible. In 2006 Glencore bought 51% of the project before selling it back to EC in 2009 at a discount due to the financial crisis. In the interim CB&I had been contracted to run the overhaul of the facility - due to the change of control that contract was reaffirmed in 2010 on a Cost Reimbursement basis i.e "let us know what we owe you"

After years of work and the creation of 1000's of construction jobs the plant was finally inaugurated in 2015 but the Controller Office immediately ordered an audit as an initial budget of US$3.77bn had ballooned to US$8.016bn - I myself am currently having some pipes changed in the apartment and as we all know the cost is only an 'estimate' but things on the outskirts of Cartagena were on a different scale.

The Controllers office now want to investigate 20 officials for a loss of US$2.4bn however a few months ago the Prosecutor's office decided it was 8 people and US$54mn - this is a constant issue in Colombia, who is running the justice system and clearly the arbitrage between the two.

Of course the politicians are involved - there have been questions over how much both Glencore as partner & CB&I as project manager knew about refining and then of course as the schism between Uribe and Santos has widened there is the blame game. Current leading candidate Ivan Duque naturally says all the bad stuff happened after Alvaro Uribe, his party leader, left office whilst the Finance Ministers during the ensuing years have all been called in for questioning - put simply all of those in power since 2004 have some responsibility - there is no Kenneth Lay defence here.

Reficar, having visited it, is a beacon of what it does, the most modern refinery in Latin America - it has a hi-tech James Bond villain style control centre that can switch between products at 24 hours notice, it is up near its 165k BPD capacity and has almost single handed helped support the industrial production data since 2015 however all that cannot be used as an excuse to mask what has gone wrong. This will likely take years more of festering, claim & counter claim to resolve - we live in a post Trump fake news era when it is hard enough to find the truth at the best of times and of course the money is as good as gone. Of the 2560 sub-contracts awarded some 18% came in at 2x budget or more - beyond that there are the stories of 'entertainment' and money being moved overseas - it is not a tale unlike many others in emerging marketsand especially Latin America but lessons need to be learn't and lets hope they are, on the bright side the current 4G projects due to the creation of the ANI have seen an end to Cost Reimbursement contracts - these days it's a case of " Get the job done and we'll send the money along".

A Space Age Project Living Under a Cloud

Comments