Sunrise Over El Dorado : Alianza : January 17th 2017

- Rupert Stebbings

- Jan 17, 2019

- 5 min read

DAILY THOUGHT : The disaster that has been EPM's Hidroituango took a baby step forward yesterday as they managed to seal one of the hatches at the potentially largest Hydro project in the country and whilst testing continues ahead of further such steps it is at least an optimistic sign for the project which would now come into service several years late providing it is salvaged. One of the biggest criticisms which has led to a bleed out of confidence levels in EPM has been the lack of information and the mixed messages from both management and the authorities - that confidence will hardly have been lifted by a photo being circulated in the press of the CEO in prayer with a priest ahead of the process, someone's public relations department needs an overhaul.

The COLCAP dropped 0.13% so two modest negative days in a row, the index closed at 1391.34 on low volume of USD29.5mn. In terms of volume the most traded stocks were PFBCOLOM (USD 5mn), GRUPOSURA (USD 4mn) and ECOPETROL (USD 4mn) whilst in terms of movement we saw good days for PFAVH (+2.23%) , PROMIGAS (+1.89%) and PFCEMARGOS (+1.79%) - to the downside were CLH (-5.86%) ,ISA (-2.39%) and CORFICOLF (-1.84%). *Corficol hit new all-time lows yesterday in all likelihood due to renewed press articles with regards to both Odebrecht and the bridge collapse at Chirajara which has just had its first anniversary* The Peso had a strong day rising 0.78% to close at 3117.43, this apparently owing to a better oil print, in the end it was the best performing currency in the region, volume on the day USD920mn which was slightly below the recent average.

The bond market saw decreases at the short end with the 2020 falling 2.5bps to 4.99% whilst at the long end the 2032 rose 2.6bps to 7.17% - meantime the benchmark 2024 was unchanged at 6.15%. *In the primary market we had the auction of COP360bn (USD110mn) of index linked bonds ranging between 2023 & 2035 - overall demand totaled COP756bn (USD235mn) with the largest allocation in the March 2027 paper*

The Central Bank published their latest survey of analysts for January and there were few changes from December. Looking briefly at the numbers we find that YE19 Interest Rates according to the Consensus will come in at 4.75% with April and August the favourites in terms of the months when those two rate increases will occur. We agree that April will see the first increase to 4.50% however we think after that there will be multiple increases driven by growth which will take us to 5.25%. In terms of inflation there has been a slight lowering of consensus to 3.47% for YE2019, we at Alianza are higher at 3.83% whilst for the month of January we are anticipating a 0.72% reading, again above the markets 0.69% estimate. Finally analysts are looking at a YE 2019 Peso of 3134, unchanged from last month's survey - the spread is very wide at 2900-3550 - we are looking for 3300.

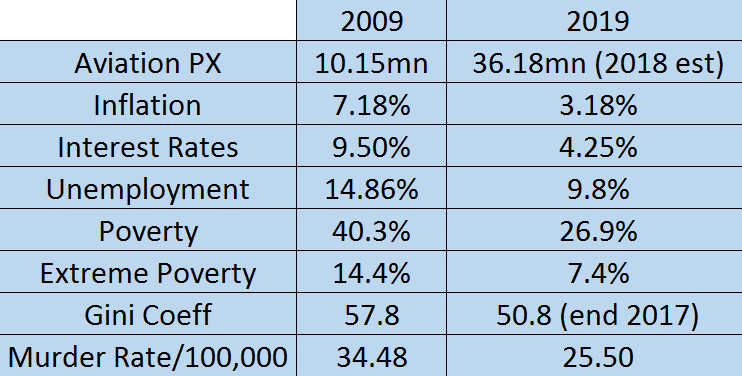

Keeping abreast of global events as we always do, despite being in a relative backwater we today take a very quick look at Colombia in terms of the latest Social Network craze - The 10 Year Challenge - a fad that is lost on the non-Millennials as we already lost our looks (and locks in my case) a decade ago however Colombia as a country has seen plenty of changes. Below is a table of ad-hoc numbers, it is not mean't to a scientific or exhaustive study however it serves the purpose of pointing to the fact that the country has moved in the right direction, there are of course continued challenges ahead which also represent opportunity but in many respects Colombia is unrecognizable from a decade ago - if it was a 20 Year Challenge we would be here until year 21 still writing - here are some brief thoughts. 1. The economy has become refreshingly boring, we had a spike in inflation back in 2016 as oil collapsed and El Niño bit hard but overall the macro data resembles far more a developed market in 2019. 2. Colombia remains a violent country but slowly but surely numbers have come downwards helped in no small part by the FARC peace agreement which has close to eliminated military deaths - another data point which has changed so much that it no longer exists is the kidnapping index, one a fear, not a rarity. 3. Colombians be it by land or air are travelling more than ever - driven by LCC VivaAir and the changes they drove in regulation the skies are fuller than ever with more growth to come but despite this bus travel last year was also up by 5% in 2018 to 134 mn passengers. Additionally over the past decade car ownership has climbed dramatically - now all we need are the roads to service such demand. 4. Poverty which we touched on earlier in the week has decreased along with unemployment over the past decade and that has enabled the GINI co-efficient to come down - whilst this is good news there is still so, so much more to do. 5. The COLCAP a decade ago stood at 832pts versus the 1390 where we are today - the Peso though has fallen from 2248 to 3100+, a reflection of a lower oil price. As important as the increase in the size of the market is the expansion those companies have made into the exterior, it would be good to see a snapshot of Colombian flags dotted around the region versus 2009 - it has been a corporate invasion. 6. The country has become one of the most stable politically in the region - a decade ago the Boliviaran revolution was already arriving of underway but there was a lack of transparency as to how they fare - they have been a disaster and Colombia did well to steer away from such a fate. As Julie Andrews would sing these are just a few of my favourite things but there are so many more that have seen improvement - house ownership & banking participation are two that spring to mind. But there are of course other areas where the country has posted an F for fail including corruption especially amongst the political class, health & education for the needy and the pension system is also archaic and needs an overhaul. Things have changed dramatically but unlike most dramas the story doesn't end with a radical change, here in Colombia opportunity knocks to be having the same discussion in 2029.

Yesterday we were discussing the benign state of the housing construction sector in terms of costs during 2018 with an increase of only 2.49% versus national inflation of 3.12% - yesterday it was the turn of the heavy construction sector and whilst the MoM increase of 0.11% was very tame with only materials (0.17%) increasing the full year increase of 3.5% was at least above inflation at least hinting at some demand in the market - it is still down on the FY17 number of 4.43% however the housing sector in 2017 was at 4.77% in the same year and has fallen back far more.

Comments