Sunrise Over El Dorado : Alianza : February 1st 2019

- Rupert Stebbings

- Feb 1, 2019

- 3 min read

DAILY THOUGHT : The head of Asobancaria was quite correctly calling for 2019 to be a year of digitalization in the banking sector, to get people on-line as opposed to in-line. Clearly this is more efficient for both the banks and the clients (much as they appear to disbelieve that) however is the country prepared or grown up enough when one of the major banks declares, as Santander did in the UK last week, that they are closing 140 branches ? Having witnessed the Unions at work in Bancolombia one seriously doubts it.

Whilst the wining streak stopped at 10 days yesterday amidst the rebalance the COLCAP has risen for 19 of the last 21 days to close January 9.13% into positive territory and 14.23% if you are a dollar investor. Brazil is the only serious country in Latam to have risen further and even the it is hardly over the horizon at this juncture. If you had offered the image below to most investors, especially those invested in stocks with ongoing Corporate Governance issues, they would have torn you hand off but the reality is Colombia looks set for a decent year. The economy is looks fine, we are still cheaper than both our Latam peers and own historical averages and market watchers have finally caught onto the idea that the changes in AFP investing rules from March will have an impact. In terms of Thursday the index lost 0.18% to close at 1447.01pts with the most traded stocks being PFBCOLOM (USD 32mn), BCOLOM (USD 21mn) and ECOPETROL (USD 19mn) due to the re-balance. In terms of movement the best performers were PROMIGAS (+3.07%), CONCONCRETRO (+2.24%) and EXITO(USD 1.44%) whilst sliding away were CLH (-4.07%) ,PFAVAH (-4.44%) and CNEC (-3.99%).

Source : Bloomberg The PESO had a serious bounce gaining 1.84% to close at 3107 having at one point touched 3104 - volume was just over USD1bn - today's action was a delayed reaction to FE D comments yesterday.

A very big day on the bond market as yields dropped all along the curve - the 2020 dropped 5.7bps to close at 4.91% whilst at the longer end the benchmark 2024 fell 7.4bps to 6.03% and the 2032 was down 11.9bps to 7.01%.

The Central Bank of course surprised nobody yesterday as they left rates at 4.25% however they did have comments on a broad range of subjects at the press conference :

They continue to look for GDP growth of 3.5% in 2019, that is above our own 3.2% as well as that published by the IFC last week of 3.3%.

They are expecting the Current Account Deficit to widen during 2019.

Recent macro data has been very positive and the Central Bank policy remains slightly expansionary - the tenor of his remarks suggests this won't be the case forever, Echavarria made mention of the fact that analyst expectations are for a rate increases in April and October.

Venezuelan migration remains a concern.

The bank will continue their policy of accumulating foreign reserves via its Put Option program with a further US$400mn but will in addition but USD1bn directly from the Government.

A Central Bank meeting will never be a non-event but this one was truly lacking in surprises.

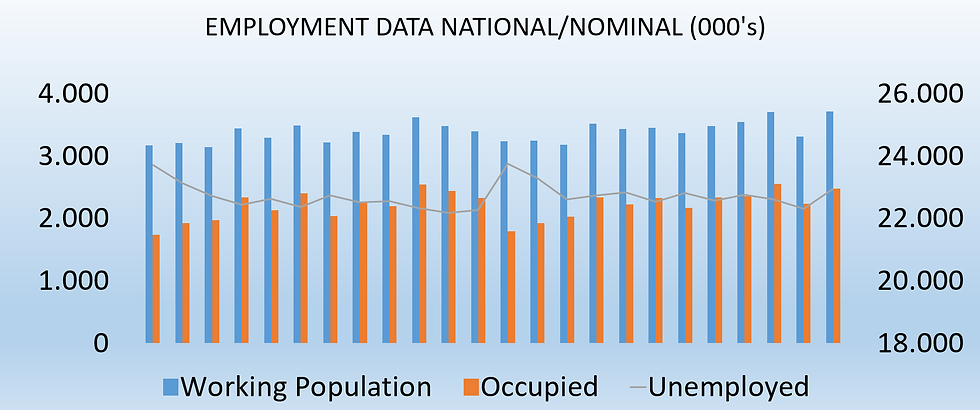

Yesterday I was optimistic that given the better November macro data that the December unemployment number would be below the 10% estimate however events transpired differently and the urban number came in at 10.7%, the worst reading for this month since 2010 - a stand out number for several reasons.

On of those reasons which needs to be kept an eye on according to the DANE is that in December of the 600,000 extra people applying for work approximately half were previously working in Venezuela, it is not clear whether they are from that country or some of the millions of Colombians previously living on the other side of the border but it is having an impact. Colombia has long been championed as having a very young demographic which is advantageous is many respects however it also means we are seeing an ever expanding workforce and jobs need to be found. If we look at total national unemployment in the same December 2010 the total economically active workforce was 21.99mn - over the past nine years that has grown by 15.58% to 25.42mn. At the same time the number of people actively working has risen from 19.5mn to 22.95mn, an increase of 17.4% - better than keeping pace however this is a struggle and in keeping with the IFC's recent comments agriculture is an area of opportunity, it is also a sector that is labour intensive.

Comments